What is the Efficient Market Hypothesis?

The Efficient Market Hypothesis (EMH) is a widely debated financial theory that posits that financial markets are efficient in processing and reflecting all available information. Consequently, it suggests that it is impossible for investors to consistently achieve higher returns than the overall market, as stock prices already incorporate all relevant information. The EMH is based on the assumption that market participants are rational, and any new information is quickly and accurately incorporated into asset prices. There are three forms of the EMH: weak, semi-strong, and strong, each representing different degrees of market efficiency.

Examples of the Efficient Market Hypothesis

-

Weak Form EMH

The weak form of the EMH posits that current stock prices fully reflect all past trading information, including stock prices and trading volumes. According to this form, technical analysis, which is based on the analysis of historical price patterns, cannot consistently generate higher returns than the market.

-

Semi-Strong Form EMH

The semi-strong form of the EMH asserts that stock prices not only reflect past trading information but also incorporate all publicly available information, such as financial statements, economic data, and news. Under this form, neither technical nor fundamental analysis can consistently outperform the market, as all public information is already reflected in asset prices.

-

Strong Form EMH

The strong form of the EMH contends that stock prices fully reflect all information, including private or insider information. This form implies that even insiders with access to non-public information cannot consistently achieve higher returns than the market.

Shortcomings and Criticisms of the Efficient Market Hypothesis

-

Market Anomalies

Various market anomalies, such as the January effect, momentum, and value effect, contradict the EMH, as they suggest that certain investment strategies can consistently generate higher returns than the market.

-

Behavioral Finance

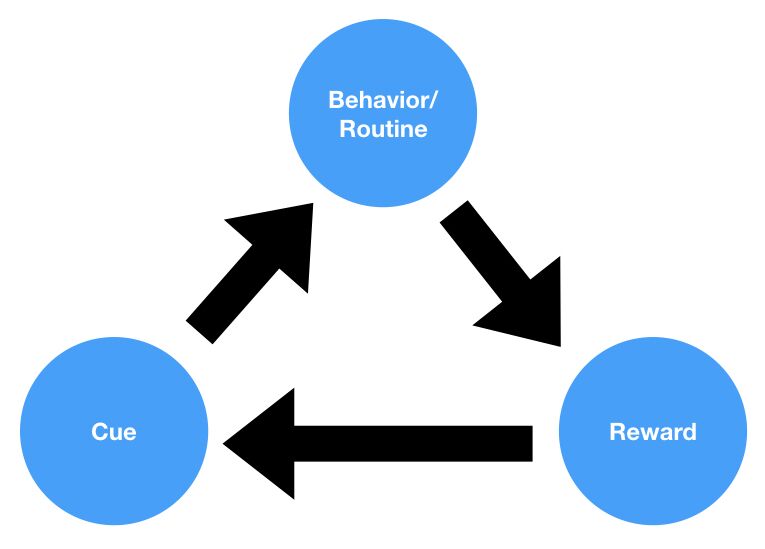

Behavioral finance, which examines the psychological factors influencing investors’ decision-making, challenges the EMH’s assumption of rational market participants. Cognitive biases, such as overconfidence, loss aversion, and herding, can lead to irrational investment decisions and market inefficiencies.

-

Financial Crises and Bubbles

Financial crises and asset bubbles, such as the dot-com bubble and the global financial crisis of 2008, cast doubt on the EMH, as they demonstrate that market participants can significantly misprice assets, leading to market inefficiencies and severe consequences for the global economy.

-

Active Management Outperformance

Although it is challenging to consistently outperform the market, some active fund managers have demonstrated long-term success, contradicting the EMH’s assertion that it is impossible to achieve higher returns than the overall market. However, it is essential to note that the number of successful active managers is relatively small compared to the total number of fund managers.